2021 tax brackets calculator

These are the rates for. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1.

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

10 12 22 24 32 35 and 37.

. Your bracket depends on your taxable income and filing status. Use the 540 2EZ Tax Tables on the Tax. It is mainly intended for residents of the US.

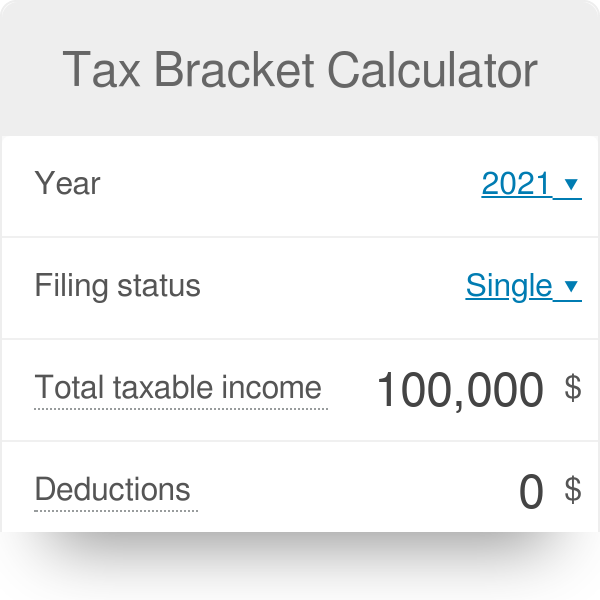

For Tax Year 2021 use the Tax Bracket Calculator below. 0 would also be your average tax rate. Tax calculator tables rates.

Calculate your income tax bracket 2021 2022 Filing Status Total Expected Gross Income For 2021 Show Advanced Options Calculate Your 2021 Income Tax Bracket. Your household income location filing status and number of personal. There are seven federal tax brackets for the 2021 tax year.

Find all 2021 tax. Tax calculator tables rates. This means that you are taxed at 205 from.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. You can use our.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. For the current tax year use this Income Tax Calculator or RATEucator. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

Calculate your income tax bracket 2021 2022. This is 0 of your total income of 0. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

HR Block Maine License. Use our simple tax calculator for Germany to work out what youll earn after paying German income. You can no longer e-File 2021 Tax Returns.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. 2021 Deductions and Exemptions Single Married Filing Jointly Widower Married Filing Separately Head of Household. Our free tax calculator is a great way to learn about your tax situation and plan ahead.

Quickly figure your 2021 tax by entering your filing status and income. Our tax preparers will ensure that your tax returns are complete accurate and on time. Your tax bracket is determined by your taxable income and filing status.

It can be used for the 201314 to 202122 income years. Ad You Can Open A TIAA IRA That Fits Your Needs Potentially Save With Tax Benefits. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. 2021 Federal Income Tax Brackets and Rates. Your bracket depends on your taxable income and filing status.

Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. 10 12 22 24 32 35 and 37.

There are seven federal tax brackets for the 2021 tax year. If you need to submit a tax declaration for 2021 the deadline is October 31st 2022 if. Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The next six levels are. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Our tax preparers will ensure that your tax returns are complete accurate and on time. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Tax calculator is for. This calculator does not figure tax for Form 540 2EZ. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10.

Your Federal taxes are estimated at 0. Effective tax rate 172. And is based on the tax brackets of 2021 and.

Calculate your 2021 tax. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The lowest tax bracket or the lowest income level is 0 to 9950. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Sales Tax Calculator

How To Calculate Federal Income Tax

Tax Calculator Estimate Your Income Tax For 2022 Free

Excel Formula Income Tax Bracket Calculation Exceljet

New Tax Regime Income Tax Slab For Ay 2021 22 For Individual Income Tax Income Tax

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Click Here To View The Tax Calculations Income Tax Income Online Taxes

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Inkwiry Federal Income Tax Brackets

Tax Bracket Calculator

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

New 2021 Mileage Reimbursement Calculator Mileage Reimbursement Mileage Calculator

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return