Hourly earning calculator

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. This calculator uses the 2019 withholding schedules rules.

Salary To Hourly Salary Converter Salary Hour Calculators

A bi-weekly payment schedule is more common when a business has multiple hourly employees.

. If you enter your annual wage then the calculator will assume you work 250 days a year 50 weeks of 5 days a week. For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week you can calculate the annual pre-tax salary by multiplying the hourly rate by 40. Calculating an Hourly salary from an Annual revenue.

Skill level and experience. Employees on hourly rates get paid in wages and are typically paid weekly or monthly. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Living Wage Calculation for California. Then multiply the product by the number of weeks in a year 52. You work 10 hours the first week of the month 15 hours the second 20 hours the third and 15 hours the fourth.

Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z. 2020 salaried employees must be classified as non-exempt if they are earning less than 684 per week or 35568 per year. The formula of calculating annual salary and hourly wage is as follow.

Enter your current salary to instantly calculate your daily wage. Use the calculator and read our guide to find out everything you need to know. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Hourly Wage Tax Calculator. The Paysliper salary calculator is a tool to convert your salary equivalents based on your companys payment frequency such as Monthly Weekly Bi weekly Semi Monthly. Quarterly Salary Annual Salary 4.

_____________ Real Earnings for August 2022 is scheduled to be released on September 13 2022 at 830 am. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Hourly and salary employees how are they paid.

Enter your current payroll information and deductions then enter the hours you expect to work and how much you are paid. Most workers that are paid an hourly wage fall under this category. Overtime pay and exemptions are factors as are the benefits of each which can vary considerably.

On top of needing to meet the requirement of earning a minimum salary of 684 per week employees that qualify for. Monthly Salary Annual Salary 12. This free time card calculator generates weekly time reports based on provided work times and hourly rates.

Companies can back a salary into an hourly wage. It can account for various overtime situations. For instance if your hourly rate is minimum wage 950 and you work 8 hours per day you will get paid 76 each day.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only. You can enter regular overtime and an additional hourly rate if you work a second job. For example lets say youre an hourly employee making 15 per hour.

Accurate reliable salary and compensation comparisons for United States. The change in real average hourly earnings combined with a decrease of 09 percent in the average workweek resulted in a 35-percent decrease in real average weekly earnings over this period. With remote back-end developers earning on average 58h and Application Software Developers being the highest paying.

You can enter your annual salary hourly wage or monthly salary and the daily wage calculator will instantly calculator what you are earning on a daily basis. Woolworths in Australia - Hourly Rate - Get a free salary comparison based on job title skills experience and education. Annual Salary Hourly Wage Hours per workweek 52 weeks.

Semi-Monthly Salary Annual Salary 24. There are various factors that determine freelance and consulting hourly rates. It is not a substitute for the advice of an accountant or other tax professional.

Here are the most important ones ordered by level of impact. A paycheck calculator is a useful way to get a realistic sense of. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a.

An hourly rate as the name suggests is a set amount of money that the employer will pay for each hour that is worked. If you want to work out your salary or take-home and only know your hourly rate use the Hourly Rate Calculator to get the information you need from our tax calculator. The assumption is the sole provider is working full-time 2080 hours per year.

Monthly Salary Calculator Online 56 Off Www Wtashows Com

Hourly To Salary Calculator Salary Calculator Salary Pre Algebra

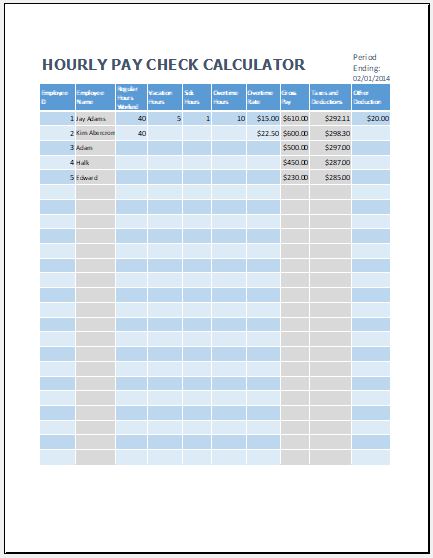

Hourly Paycheck Calculator Template For Excel Excel Templates

Hourly Payroll Calculator Sale 60 Off Www Wtashows Com

Hourly To Annual Salary Calculator Online 59 Off Www Ingeniovirtual Com

Hourly To Salary What Is My Annual Income

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly Rate Calculator The Filmmaker S Production Bible

Hourly Paycheck Calculator Step By Step With Examples

Hourly Rate Calculator

Hourly Rate Calculator Plan Projections Rate Calculator Saving Money

How To Calculate Payroll For Hourly Employees Sling

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Annual Salary Calculator Online 59 Off Www Ingeniovirtual Com

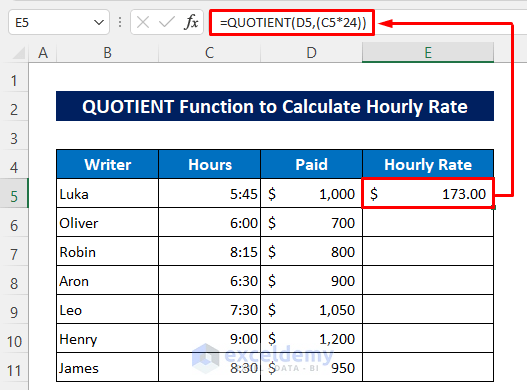

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Monthly Salary Calculator Online 56 Off Www Wtashows Com

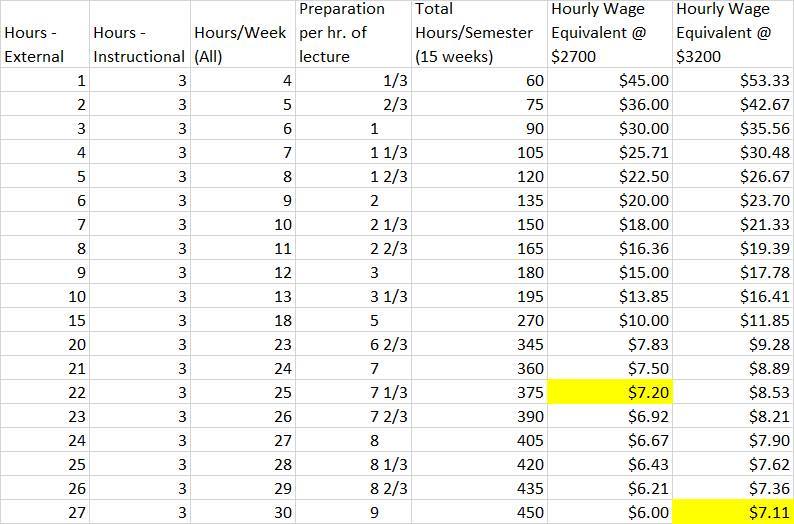

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness